2118-ea bir form|real estate tax amnesty philippines : iloilo BIR Form No. 1927. Download | | s40 Requirements Application and Joint . Boost Your Bankroll With Exclusive TAYA365 Promotions. For those seeking to elevate their gaming experience and increase their winnings, exclusive TAYA365 promotions offer a compelling opportunity. By strategically utilizing a variety of promotions, players can enhance their bankroll and enjoy a more rewarding online casino journey.

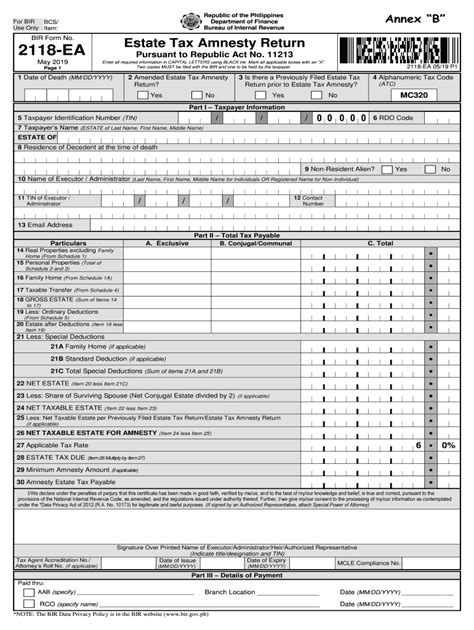

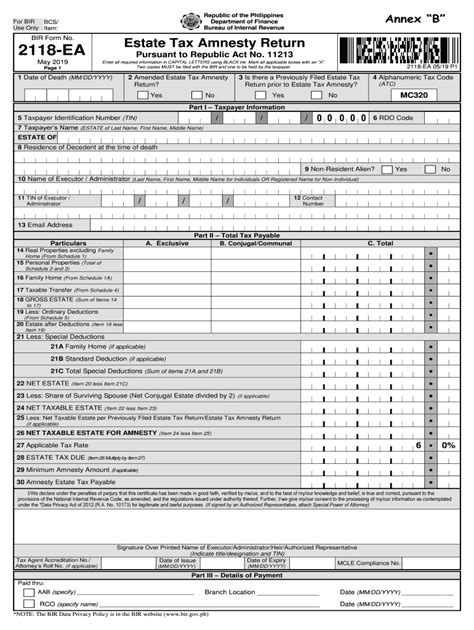

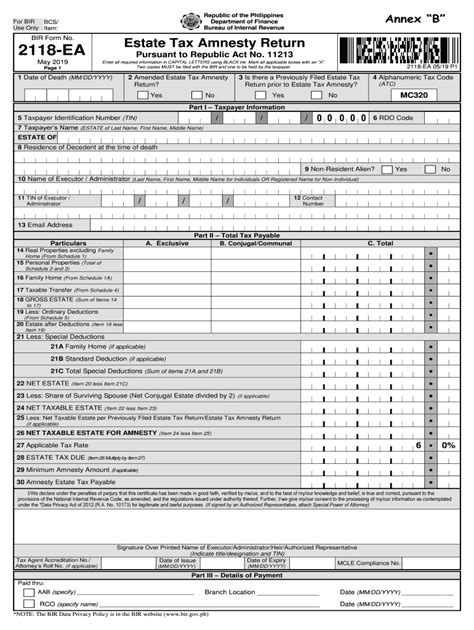

2118-ea bir form,BIR Form No. 2118-EA. Download | (G uidelines) Estate Tax Amnesty Return (Pursuant to Republic Act No. 11213) Description. This return shall be filed in triplicate by the .

The tax rates and nature of income payments subject to final withholding .

Account Information Forms - Other Forms - Bureau of Internal Revenue

BIR Form No. 1927. Download | | s40 Requirements Application and Joint .BIR Form No. 1800. Download | Donor’s Tax Return . Description. This return .

Yes, BIR Form 1905 (Application for Registration Information . 19. .

Amends certain provisions of RR No. 6-2019 to implement the extension of the .

Amends certain provisions of RR No. 6-2019 to implement the extension of the Estate Tax Amnesty pursuant to RA No. 11569, which amended RA No. 11213 (Tax Amnesty Act) .

BIR Form No. 2118-EA. July 2021 (ENCS) Page 1. Estate Tax Amnesty Return . Pursuant to Republic Act (R.A.) No. 11213, as amended by R.A. No. 11569 . Enter all required .

Guidelines and Instructions for BIR FORM No. 2118-EA [July 2021 (ENCS)] Estate Tax Amnesty Return. Who Shall File. This return shall be filed in triplicate by the .. implement the extension of the Estate Tax Amnesty pursuant to RA No. 11569, which amended RA No. 11213 (Tax Amnesty Act) (Published in Philippine Star on August 4, .

2118-ea bir formRepublic of the Philippines Department of Finance Bureau of Internal Revenue. BIR Form No. 2118-EA. May 2019. Page 1. Estate Tax Amnesty Return. Pursuant to Republic Act .(from BIR Form No. 2118-EA) 16 Minimum Amnesty Amount . 17 Amount Payable . I/We declare under the penalties of perjury that this certificate has been made in good faith, .

To avail of the estate tax amnesty, administrators, executors, legal heirs, transferees or beneficiaries must file the Estate Tax Amnesty (ETAR), or BIR Form .1) This document provides guidelines and instructions for filing Estate Tax Amnesty Return Form No. 2118-EA under the Tax Amnesty Act. 2) The return must be filed within two .This document provides guidelines and instructions for filing Estate Tax Amnesty Return Form No. 2118-EA. It outlines who must file, when and where to file, tax rates and basis, .Annex B 2118-EA v2.pdf - Free download as PDF File (.pdf), Text File (.txt) or read online for free. This document is an Estate Tax Amnesty Return form from the Bureau of Internal Revenue of the Philippines. It provides instructions and sections for taxpayers to report information related to estate taxes, including: [1] taxpayer identification details; [2] .BIR Trunkline; Directory. National Office; Regional/District Offices; Revenue Data Centers; Home; Transparency. BIR Transparency Seal; BIR Organizational Structure; . (Tax Amnesty Act) (Published in Philippine Star on August 4, 2021) Digest | Full Text | Form 2118-EA | 2118-EA Guide | Form 0621-EA | Annex D August 3, 2021 RR No. 18-2021 .We would like to show you a description here but the site won’t allow us.

6. Certification of the Barangay Captain for the last residence of the b.2 Attorney’s Roll Number; and. decedent and claimed Family Home, if any b.3 Mandatory Continuing Legal Education Compliance Number. 2118 EA Guidelines - Free download as PDF File (.pdf), Text File (.txt) or read online for free. guidelines.real estate tax amnesty philippines2118-EA 0919 ENCS final - Free download as PDF File (.pdf), Text File (.txt) or read online for free. The document is an Estate Tax Amnesty Return form from the Bureau of Internal Revenue of the Philippines. It provides instructions for reporting estate tax owed under the country's tax amnesty program. The form collects information about the deceased .BIR Form No. 2118-EA Download . Republic of the Philippines. All content is in the public domain unless otherwise stated. About GOVPH. Learn more about the Philippine government, its structure, how government works and the people behind it. .

For purposes of these Regulations, the Estate Tax Amnesty Return (ETAR) (BIR Form No. 2118-EA) (Annex B) shall be filed and paid, either electronically or manually, by the executor or administrator, legal heirs, transferees or beneficiaries, who wish to avail of the Estate Tax Amnesty within June 15, 2023 until June 14 2025 with any authorized .BIR Trunkline; Directory. National Office; Regional/District Offices; Revenue Data Centers; Home; Transparency. BIR Transparency Seal; BIR Organizational Structure; . (Tax Amnesty Act) (Published in Philippine Star on August 4, 2021) Digest | Full Text | Form 2118-EA | 2118-EA Guide | Form 0621-EA | Annex D August 3, 2021 RR No. 18-2021 .

2118-ea bir form|real estate tax amnesty philippines

PH0 · real estate tax amnesty philippines

PH1 · philippine tax amnesty program 2022

PH2 · philippine tax amnesty

PH3 · philippine estate tax amnesty pdf

PH4 · estate tax philippines amnesty

PH5 · bir form download

PH6 · affidavit of no operation bir

PH7 · Iba pa